Invest Intelligently, Grow Confidently

Data-driven insight • Active risk management • Zero commissions.

- Fiduciary • Fee-Only • Registered Investment Adviser

Your money should work as hard as you do. Our data-driven portfolios grow and protect wealth so you can focus on what matters most.

Your Portfolio. Your Control.

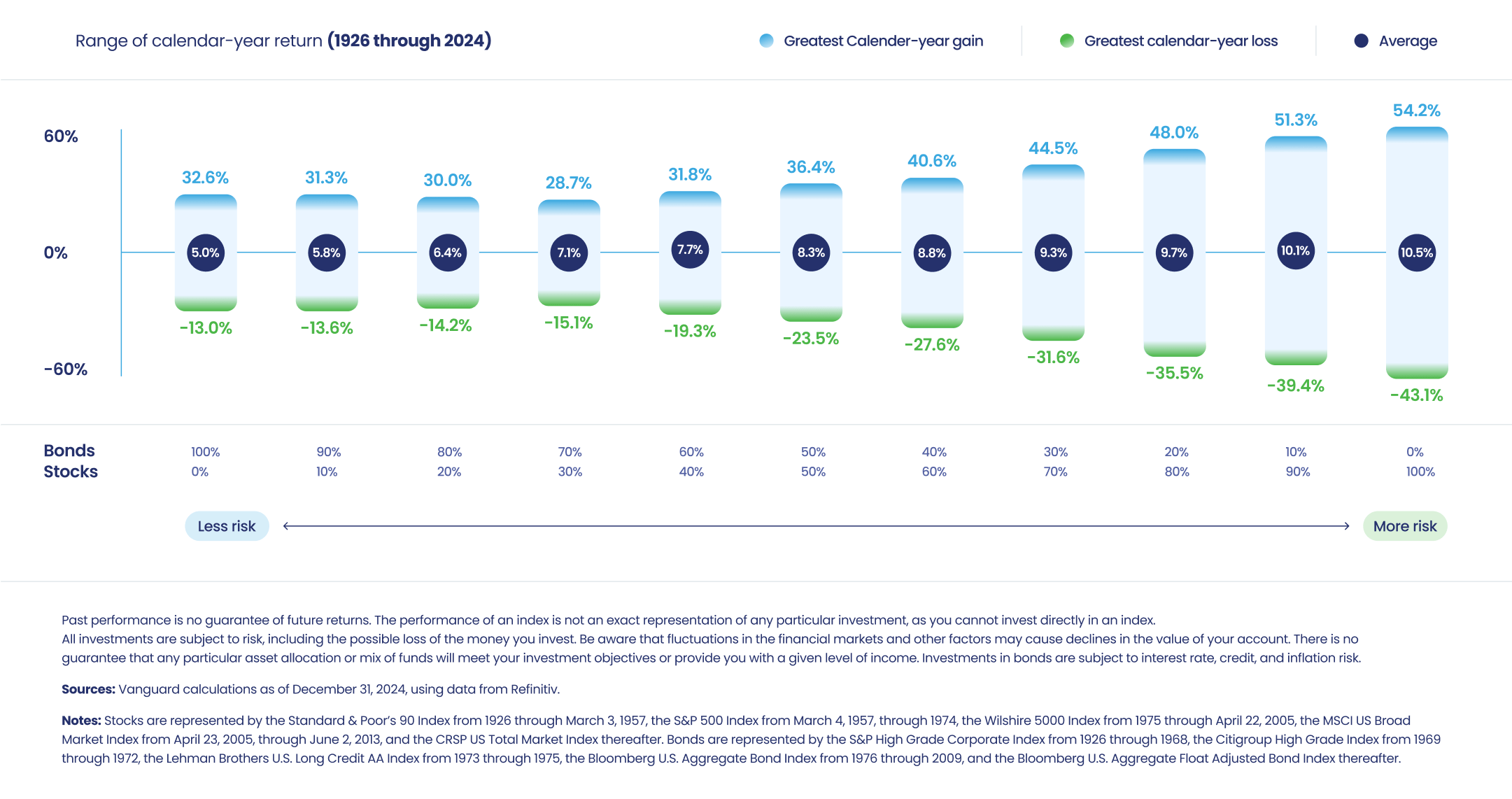

Your investment strategy should reflect both your financial goals and your comfort with market fluctuations. Our portfolios range from conservative to growth-oriented, each carefully calibrated to balance potential returns with acceptable levels of risk:

Short-Term

Stable returns that outperform typical savings accounts

Conservative

Designed for stable, modest growth with reduced volatility

Moderate

Balanced approach between growth and stability

Growth

Maximized long-term growth potential for those with extended time horizons

The Strength of True Diversification

No single market wins every year—that’s why we diversify across 30,000+ global securities.

Global Stock Markets

Own thousands of companies worldwide, capturing broad growth while reducing single-region risk.

Comprehensive Bond Exposure

Blend government, corporate, and inflation-protected bonds to steady returns, generate income, and buffer equity volatility.

Geographic Diversification

Allocate across U.S., developed, and emerging markets to balance currencies, policy cycles, and economic drivers for smoother performance.

Benefits of diversification.

Diversification helps balance opportunity and risk—so your portfolio can work in every market environment.

Smoother Returns

Reduced Risk

Capture Global Growth

Tax Efficiency

Fixed Income Sector

as a percent of long fixed income assets

Benefits of diversification.

Diversification helps balance opportunity and risk—so your portfolio can work in every market environment.

Smoother Returns

Reduced Risk

Capture Global Growth

Tax Efficiency

We Focus On Data, Not Forecasts

We rely on three key indicators to drive our decisions: Market Trends, Market Sentiment, and Monetary Policy. No crystal balls—just hard data when it matters most.

Market Trends

More buyers than sellers? Markets rise. More sellers than buyers? Markets fall. Simple, yet powerful. We track hundreds of trend indicators to spot these patterns before others do.

Market Sentiment

Excessive optimism often precedes disappointment. Deep pessimism frequently signals opportunity. We monitor investor confidence and cash reserves to stay ahead of these emotional swings.

Monetary Policy

Money flows drive the market. Abundant cash pushes prices up. Tight liquidity pulls them down. We track interest rates, bank reserves, and lending patterns to anticipate these shifts.

We navigate markets so you don't have to. Your finances get professional management. You get to focus on what truly matters—family and career.

Your financial future deserves precision, not predictions. Let's put our approach to work for your wealth.

Active Management. Real Expertise

Markets are dynamic and constantly evolving. Our investment team conducts ongoing analysis of:

- Economic indicators and monetary conditions

- Market sentiment and investor positioning

- Sector rotations and emerging opportunities

- Risk factors across global markets

We don’t simply buy and hold. We actively adjust your portfolio in response to changing market conditions while maintaining your strategic allocation targets.

The Fiduciary Difference

As a Registered Investment Advisor, we have a legal obligation to put your interests first. This means:

- We never accept commissions or kickbacks from investment products

- Our recommendations are based on merit, not compensation

- We avoid the conflicts of interest common at large banks and brokerages

- Our success is measured by your success

Investment Management Services Cela Wealth Management bases its Investment Management fees for portfolio management on a percentage of assets under management. Insert Tiered Fee Table

This is a blended fee schedule. This means that the assets in the client’s account will be billed at different levels according to the fee schedule above. Each asset tier shall be assessed a fee percentage in accordance with the fee schedule shown above. The cumulative fee percentage for the account shall be a blended rate based on the fee percentages applied to each asset tier. For example, if you have $2,750,000 AUM, we bill 1.00% on the first $2M, plus 0.80% on the next $750K.Additional fees for Financial Planning may apply. Clients who receive Investment Management services and request a financial plan are not billed for the financial plan if their account balance is in excess of $1.0 million.

Let's Build Your

Investment

Strategy

Disclaimer

All investing involves risk, including loss of principal.